Arm Holdings: The chipmaker aspires to have a market capitalization of more than $50 billion.

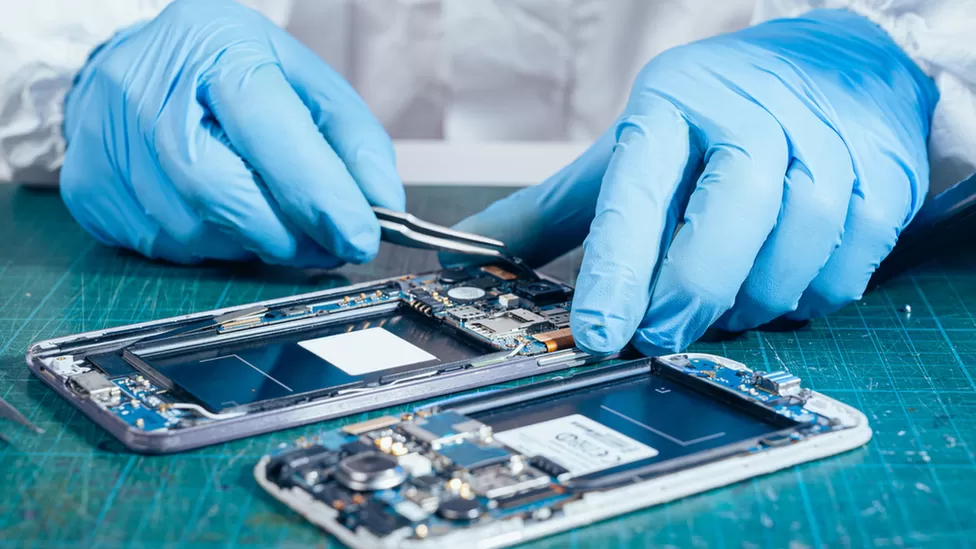

The business, which manufactures processors for devices such as smartphones and game consoles, is looking to raise roughly $5 billion in a US IPO.

It is expected to be the largest offering of the year and is viewed as a litmus test for market confidence.

It comes after intense pressure by the UK government to list in London.

Before the decision to pursue the Nasdaq listing was announced earlier this year, Prime Minister Rishi Sunak personally engaged in negotiations.

Is the London stock exchange losing its luster?

Critics argue that £1 billion for the UK chip industry is insufficient.

In the chip war, the United States is beating China.

Rene Haas, the company’s CEO, has stated that the company’s material intellectual property, headquarters, and activities will remain in the United Kingdom.

Arm Holdings, a British IT sector star, believes that 70% of the world’s population utilizes devices based on its processors, including nearly all cellphones.

Softbank, a Japanese investment corporation, owns the company. Softbank purchased the company in 2016 for $32 billion. It had been listed in both London and New York for 18 years prior to the purchase.

Softbank will retain 90% of the company’s shares following the share sale, which is smaller than originally envisaged. The stock is anticipated to begin trading next week.

Arm disclosed in a regulatory statement on Tuesday that it was selling 95,500,000 shares in the transaction at a price likely to range between $47 and $51 per share. That would place its market value somewhere between $50 billion and $54 billion.

It said it had already lined up some of its biggest clients as investors, including Apple, Google, and Nvidia, who have committed to buying $735 million worth.

Softbank, which has suffered significant losses on ventures like as co-working startup WeWork, has previously considered selling Arm to Nvidia in a $40 billion transaction. This effort was shelved in 2022 as authorities expressed concerns about competitiveness.

The most recent strategy provides a method for gradually reducing its holdings.

The share offering is being widely monitored since semiconductors are at the forefront of the technical power struggle between the United States and China.

China accounts for roughly 25% of the company’s sales, which have been hampered in recent months by a drop in smartphone shipments. The company previously stated that overall sales was essentially unchanged for the fiscal year ending March 31.