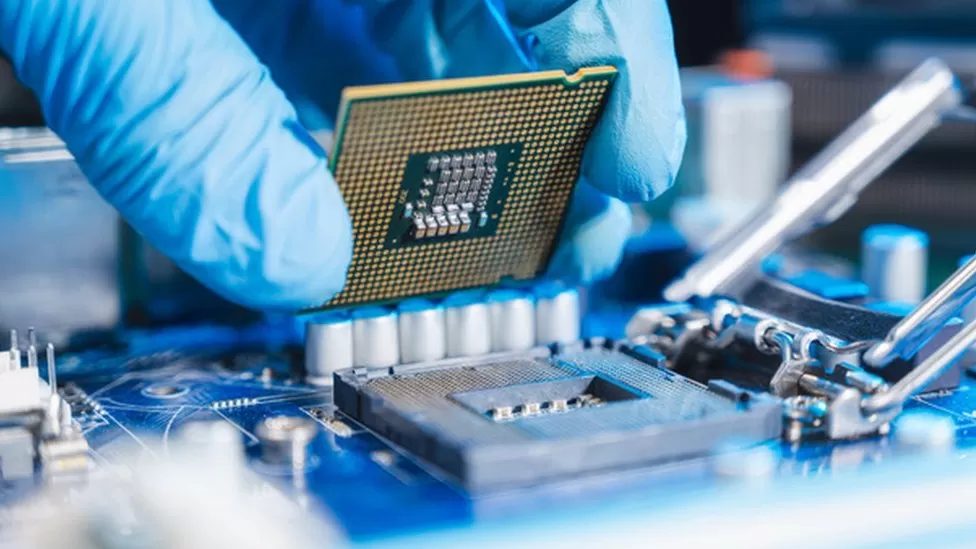

The Cambridge-based business, which manufactures semiconductors for everything from cellphones to game consoles, intends to go public on the Nasdaq in September.

Although Arm withheld information regarding the price or the quantity of shares available for purchase, its anticipated initial public offering (IPO) may be the largest listing this year.

In a setback for the UK, the company decided not to offer shares in London in March.

Arm revealed on Monday that it had now officially filed a registration statement for a potential initial public offering (IPO). It stated that both the number of shares to be auctioned and their price range had not yet been decided.

However, the corporation is reportedly seeking a valuation of $60 billion (£47 billion) to $70 billion (£55 billion).

In a deal of £23.4 billion, Japanese company Softbank acquired Arm in 2016. It had been listed for 18 years in both London and New York prior to the takeover.

Manufacturers like the Taiwan Semiconductor Manufacturing Company and businesses like Apple and Samsung use its chip design guidelines and technologies to build their own CPUs.

A corporation becomes public when it is listed on a stock exchange, enabling investors to buy and sell shares of its stock on designated exchanges.

According to prior reports, the company hoped to raise between $8 billion and $10 billion by listing on the Nasdaq platform, which is dominated by technology. On the Nasdaq, you can trade shares of other significant technological companies like Google, Apple, and Facebook.